working capital funding gap calculation

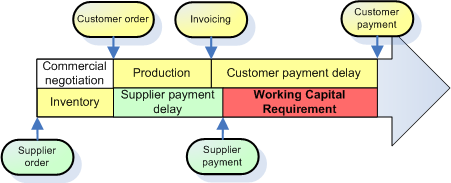

We need to calculate Working Capital using Formula ie. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by.

Modelling Working Capital Adjustments In Excel Fm

𝑟𝑓 𝑃1𝑇 In addition companies must also provide all the.

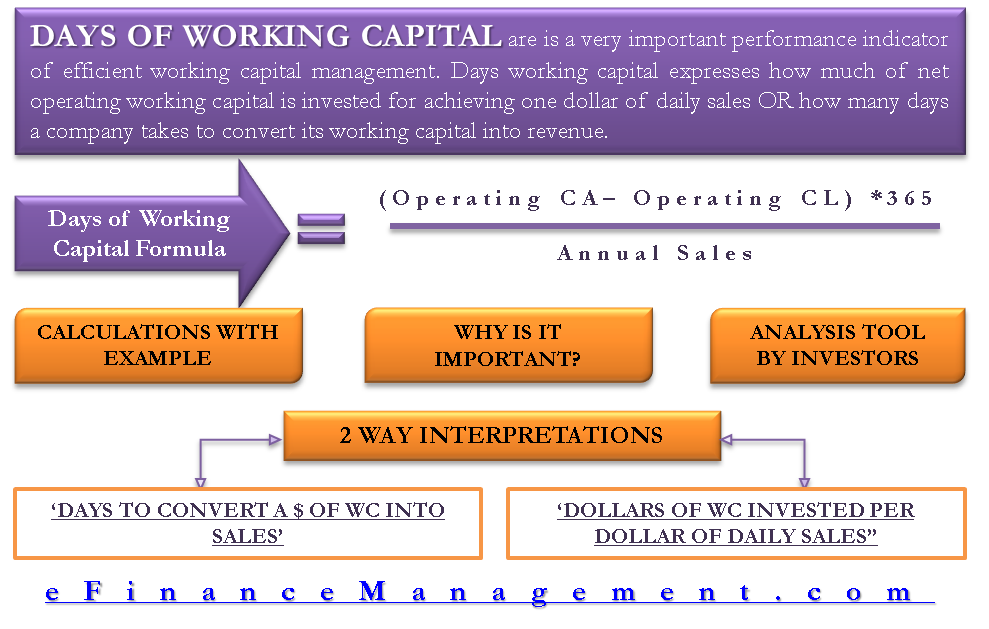

. Here the working capital calculation considers. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. The days working capital is calculated by 200000 or working capital x 365 10000000.

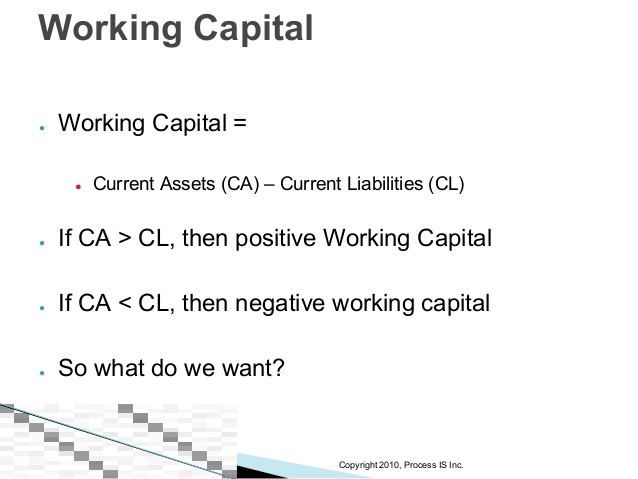

To calculate the working capital needs one needs to use the following formula. However if the company made 12. A working capital formula determines the financial health of the.

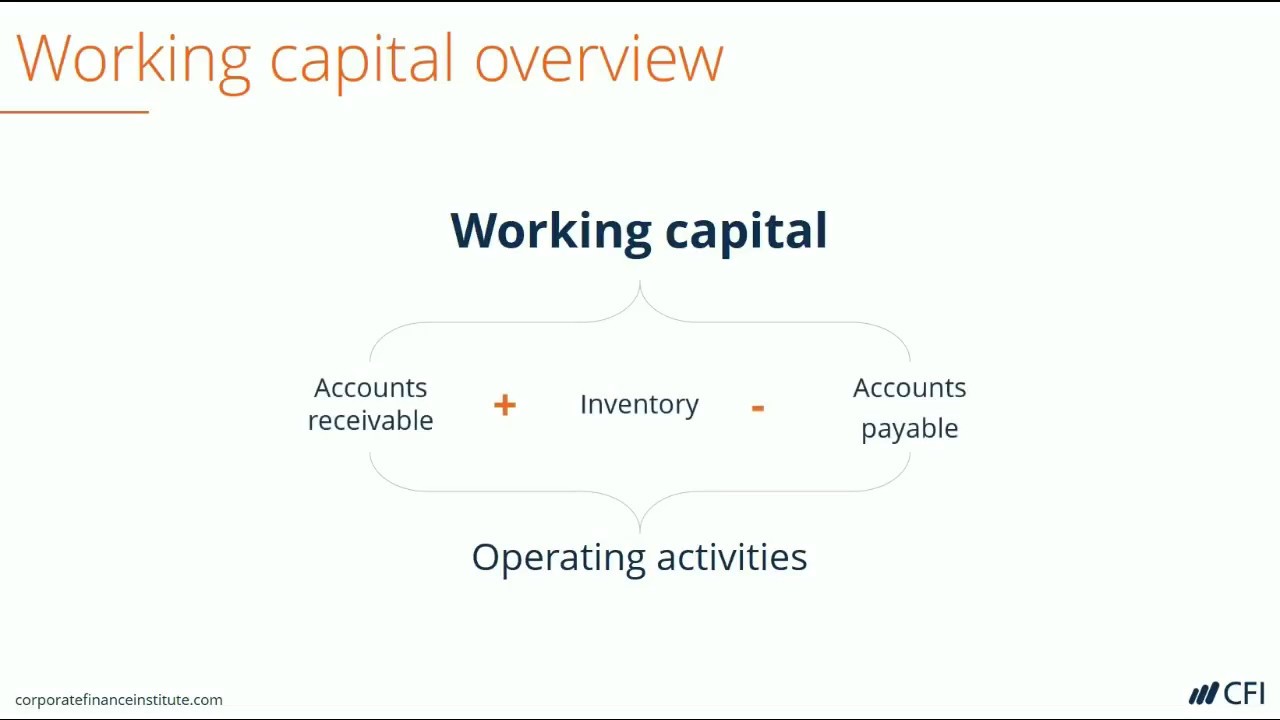

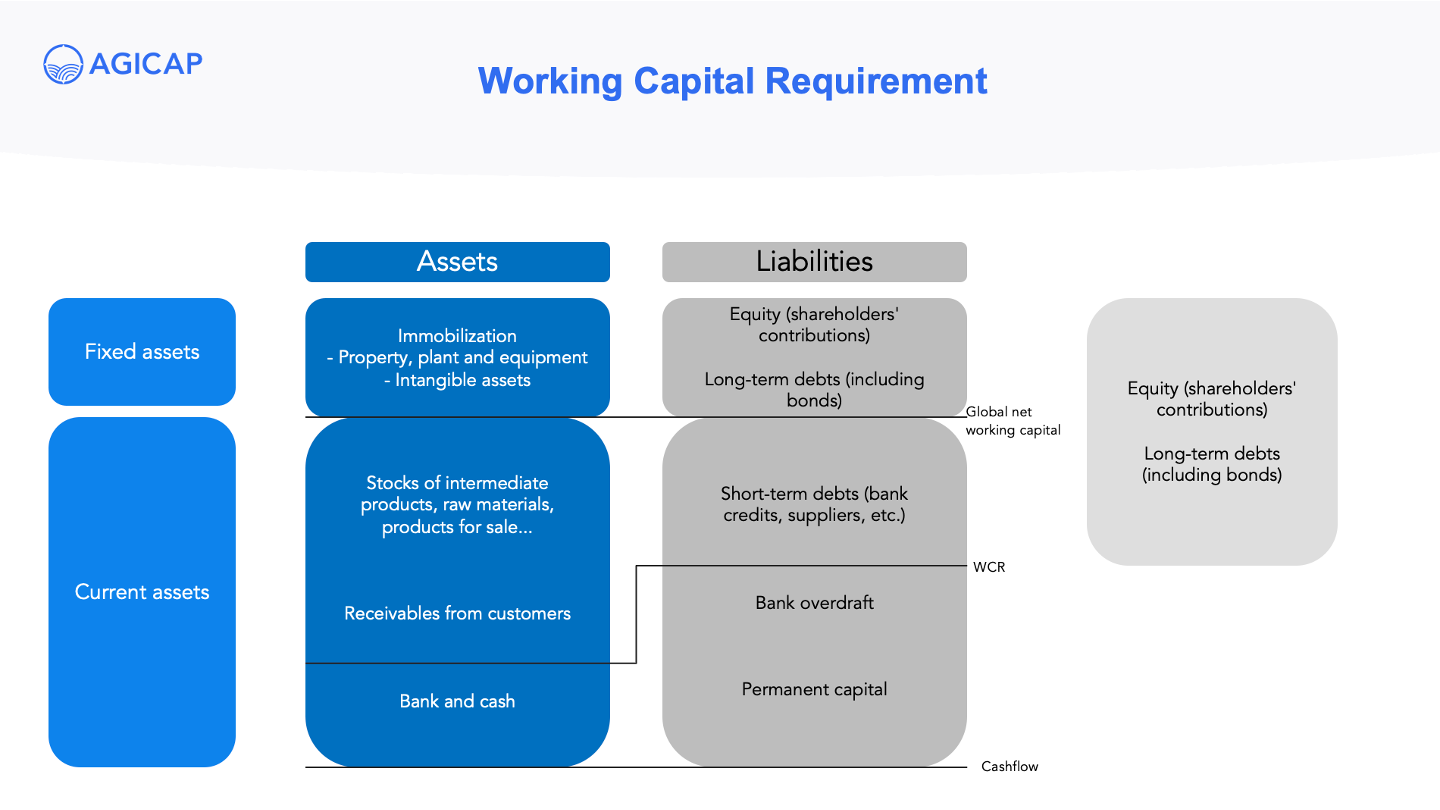

The working capital formula tells us the short-term liquid assets available after short-term liabilities. Working Capital Current Assets Current Liabilities. Here the working capital calculation considers.

If however the business chooses to use long term finance this flexibility is. Ad Working capital supply chain finance advice from leading industry experts. Net working Capital Current Assets Current Liabilities.

90 days 90 20k invested x 90 18k 38k paid back. A financial metric representing the operating liquidity available to a business. Whats the companys working capital funding gap in days based on the information below.

Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank. See why working capital management is no longer only a treasury function. It can also be described.

QuickBridge Working Capital Loans. Working Capital Current Assets Current Liabilities. Funding is what you have available to use in your business or in a very simple calculation you can say that working capital is the difference between all the current assets and all the current.

But how do you calculate it for. To calculate the working capital needs one needs to use the following formula. The justification consists in demonstrating that the internal company WACC results from the following formula.

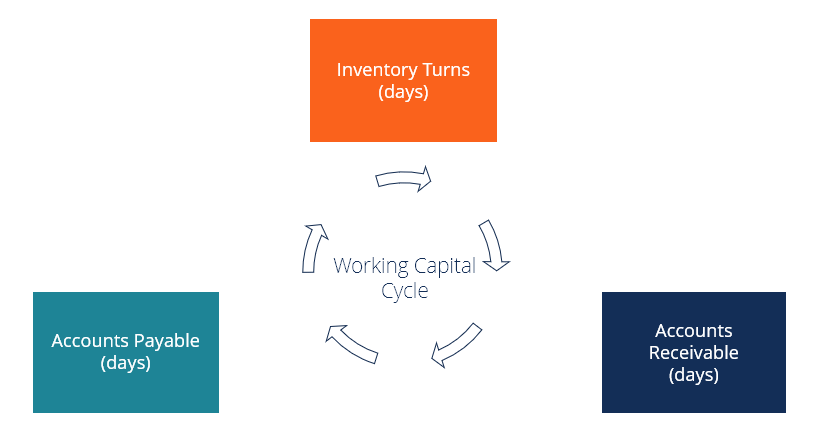

Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. Funding From 5K-500K In As Little As 24 Hours. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625.

Working Capital WC for short is an accounting term. Check out our trade and receivables financing options. The working capital formula is.

The working capital formula is. Working Capital Gap. The companys working capital would equal 200000 or 500000 - 300000.

Ad Working Capital Loans Made Simple. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. 𝐴.

QuickBridge We Say Yes When Others Say No.

Working Capital Requirement Wcr Agicap

Working Capital Formula Youtube

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

What Is The Working Capital Turnover Ratio Quora

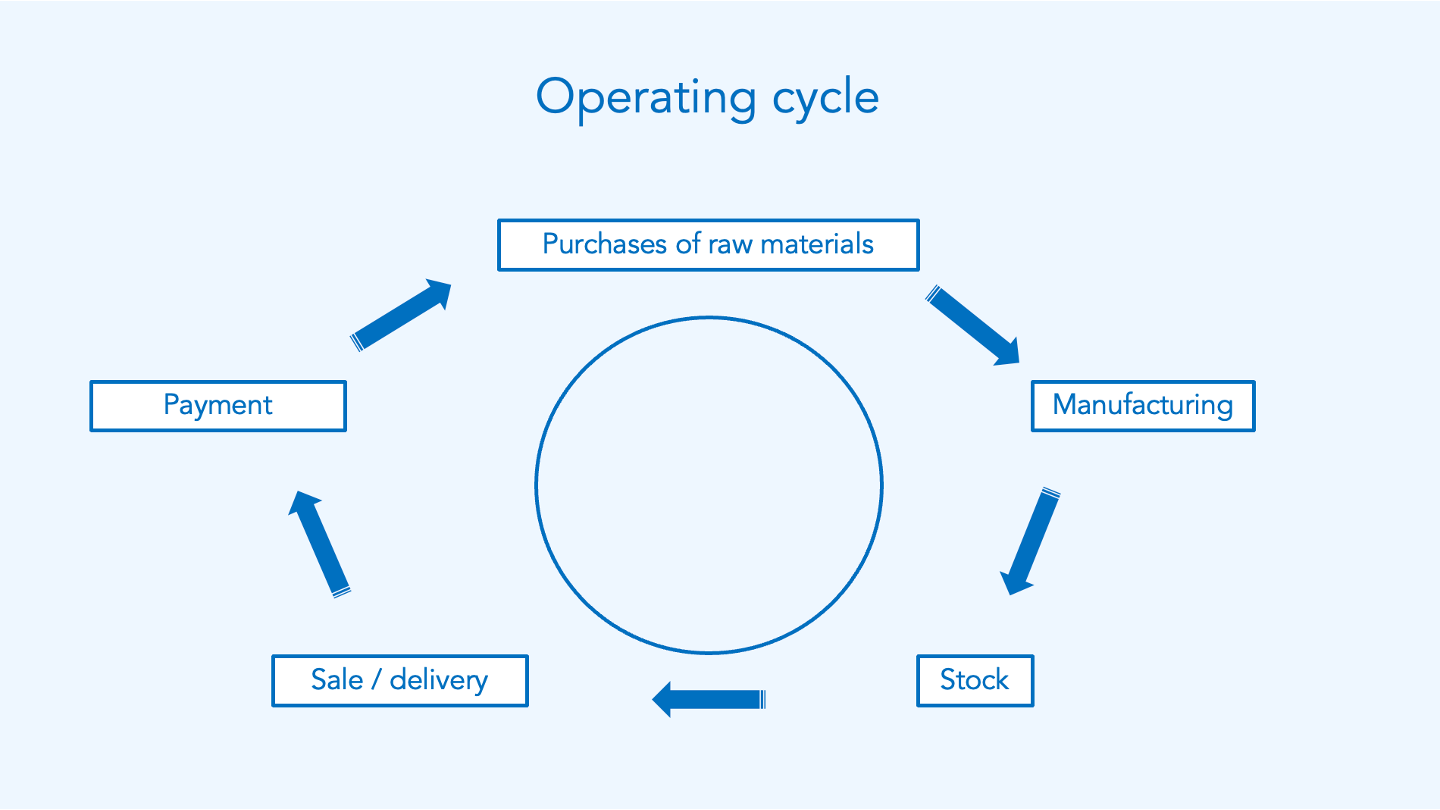

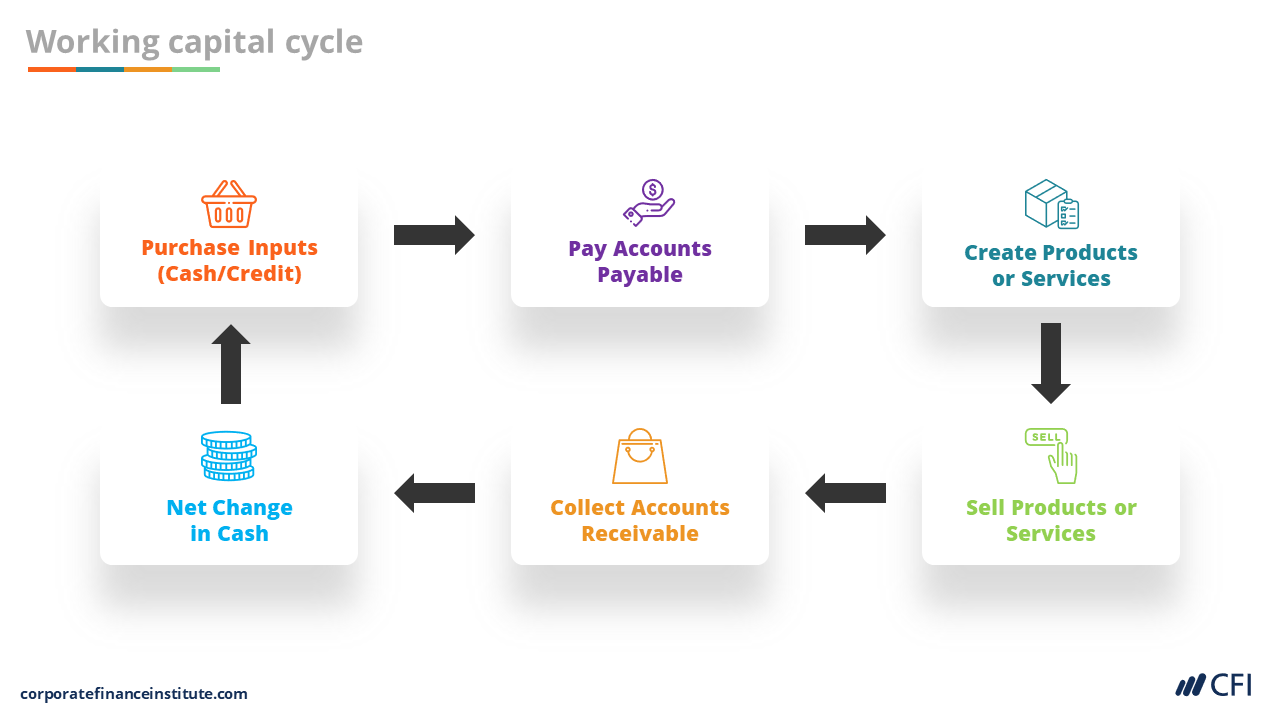

Working Capital Cycle Efinancemanagement

Working Capital Management Estimation And Calculation

What Is The Working Capital Turnover Ratio Quora

Working Capital Cycle Understanding The Working Capital Cycle

Days Working Capital Formula Calculate Example Investor S Analysis

What Is Working Capital Gap Banking School

Working Capital Financial Edge Training

Working Capital Cycle Definition How To Calculate

Working Capital What Is Working Capital Youtube

How To Improve Working Capital With Efficient Credit Management

Working Capital Requirement Wcr Agicap

Cash Flow Cycles And Analysis Cfi

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)